This article may include affiliate links, which at no cost to you, Speak Of The Angel earns a commission from if you click through and make a purchase.

Budgeting is definitely something that I seriously struggle with (like…seriously). But it’s something that I’m trying to learn more about and practice more often. So instead of trying to figure it out on my own, I thought I would bring my budgeting journey to the blog—starting out with 4 of the most effective budgeting tips I found on the internet. I’ve tried so many different methods—from tracking apps to excel sheets—but these 4 steps are what I found to be the least gimmicky methods, and that actually resonated the most.

1. Understand the Goal

First and foremost, before you start any task really, you need to understand your goal. What are you trying to achieve in budgeting? To control our spending in x category. Why are you budgeting? To get out of debt. When you have a clear understanding of exactly why you’re trying to achieve a goal, it will provide you with the drive to actually followthrough.

If you start out with a vague and broad goal like just “saving money” or “spending less”, you’re going to forget that goal faster than you can say “holy sh*t, I’m broke”. Make sure you’re setting specific goals so that you actually feel motivated to budget. However you choose to budget, it should meet this goal. If it doesn’t, you’re doing it wrong.

2. Know Your Credit Score

As Nicole Lapin confirms in her book “Rich Bitch”, “checking your own credit is a once-a-year thing. It’s an annual financial physical”. If you can be worried enough about your health that you go get your physicals and (for the females) pap tests, then you can surely check on your credit score at least once a year to make sure you are still in the green. Trust me, it’s a lot less of an invasive and uncomfortable checkup. My favourite tool to use to check my credit score is Borrowell.

Borrowell is a free credit monitoring software that let’s you check your credit scores & reports without harming your credit score, while also providing you with personal loans and product recommendations. This was especially helpful when I was apartment hunting and needed to get my credit score check. If you get your bank to check your credit score for you, it WILL harm your credit score. So do it yourself!

3. Use the 3 Category Budget

For the first 2 months of your budgeting, you should track every dime that you spend just so you get a good idea of what your spending habits look like and where you need to make a change. But after those two months have passed, there is no need for you track EVERY transaction that you make. Certain expenses become redundant to track as you know your behaviour won’t change. For example, it’s interesting to know how much you spend on gasoline every month, but is that really going to be different month to month?

Most people just overspend in a couple of categories. So once you’ve identified those categories, you can start to only track those categories and monitor your spending there. Common examples include eating out, shopping, and entertainment. Pick 3 budget categories you’d like to tame and focus on monitoring those habits. This way, you’re able to redirect your focus and only think about those 3 specific categories when you are out and about, and it will save you a lot of time as well.

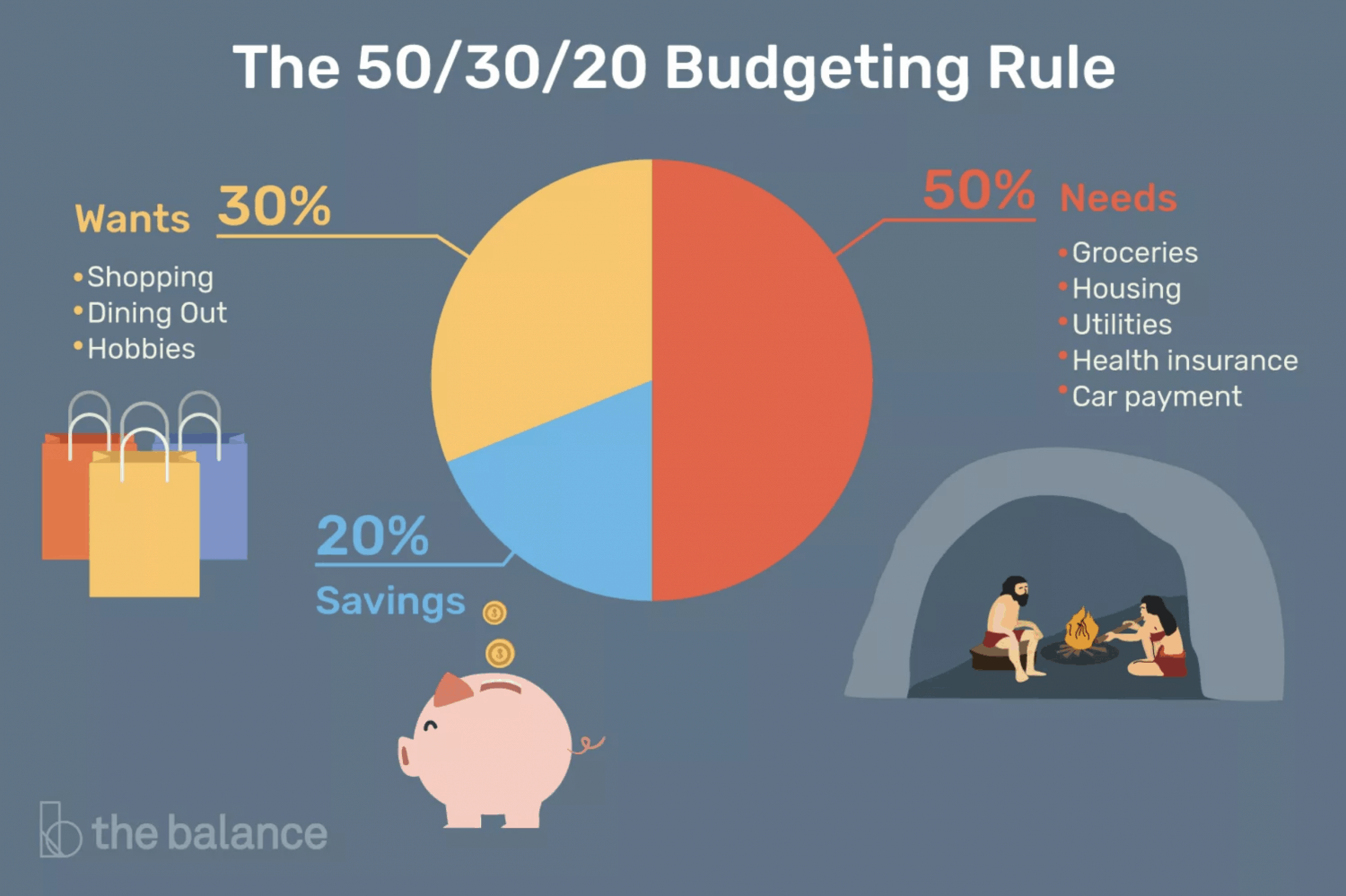

4. Try the 50/20/30 Plan

Once you actually have your finance analysis down, it’s time to divvy up your income to the right places. There are several different ways that you can do this, but my favourite by far has been the 50/20/30 rule.

How does the 50/20/30 rule work?

First, calculate your after-tax income amount. This means after your income taxes, medicare coverage, and whatever else is automatically taken out of your income. If you’re self-employed, this means your gross income for the month, minus your business expenses.

After you figure out your net income (or your income after expenses), you’ll want to limit your needs to 50% of your income. This is your rent, groceries, utilities, health insurance, car payments, and anything else that you NEED to live for the month.

Next, limit your wants to 30% of your income. This is the amount that you can spend shopping, eating out, going to the movie… whatever pleases you.

The last 20% if your net income should go to repaying your debts and/or into your savings. If you carry a credit card balance, the minimum payment is a “need” and it counts towards the 50%. Anything extra debt repayments you need to make goes in this 20% category.

I am definitely no personal finance expert, but these are the best tips and tricks that I’ve found has worked for me. For those of you who are carrying some debt on your shoulders right now and feeling hopeless, don’t fret. I’m right there with you. Continue to search out different methods and tips to become debt free. Let’s own our debt together ??.